Transportation Costs: Complete Breakdown [+How to Calculate Expenses]

We break down the transportation costs in last mile delivery to show you what affects it, how to calculate it, and how to lower transportation cost.

Home > Blog > How to Calculate Cost Per Mile [+How to Track It]

Delivery LogisticsLearn how to calculate cost per mile for your business, track key expenses, and optimize transportation costs with effective strategies and software tools.

Calculating the cost per mile can be insightful for businesses that rely on transportation to deliver goods or services. Whether you’re managing a single vehicle or an entire fleet, understanding how to track this key metric can significantly impact your bottom line.

In this guide, we’ll walk you through how to calculate cost per mile, what factors influence it, and how you can track and reduce your transportation costs. By accurately calculating this figure, you can optimize operations and improve efficiency, ultimately leading to more profitable business practices.

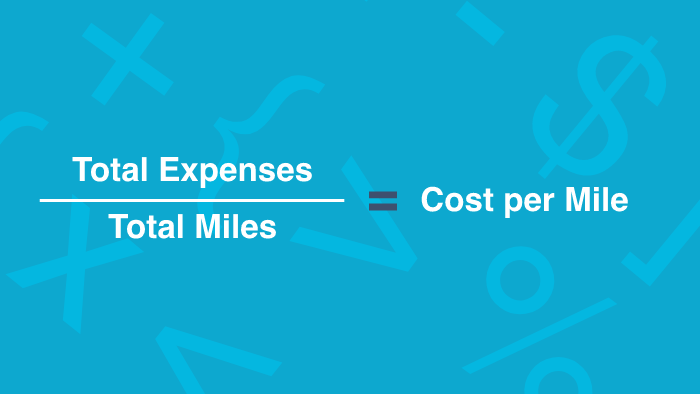

To calculate cost per mile, divide your total expenses by the total miles you have driven for a selected period:

For example, if your total monthly expenses are $5,000 and you drove 10,000 miles, your cost per mile is $0.50.

You can measure cost per mile for any period: daily, weekly, monthly, quarterly, semi-annual, or annual cost per mile.

You can also measure cost per mile for a single vehicle. Or you can calculate the average cost per mile for your entire fleet. But the formula for calculating cost per mile stays the same in both cases.

The formula remains the same if you use kilometers, and is called Cost per Kilometer.

On average, the current cost per mile for business use in 2025 is 70 cents per mile ($). (Source)

Here’s a breakdown of the cost per mile by market:

As you can see, there isn’t too much difference between the regions.

Basically, it’s cents on the dollar.

But when you add those cents up, it makes for a pretty substantial business cost.

Especially considering that the average cost per mile is increasing 1-2% year-over-year.

So…

To calculate cost per mile, you need to track certain key metrics in logistics.

Specifically:

You need to know what your business costs are and how far you drive over a given period.

But what makes up your operational expenses?

And how do you determine your mileage?

In this part of the article, we’ll answer these questions.

Here are 5 things you need to calculate cost per mile:

#1 Fixed Costs

#2 Variable Costs

#3 Miles Driven

#4 Vehicle vs. Fleet

#5 Observed Period

You can’t know how much money you spend per mile if you don’t know what you’re spending.

The best starting point is to look at your fixed expenses.

Fixed operating costs are predictable expenses that stay the same over long stretches of time. Fixed costs include employee salaries, rent for offices and other facilities, insurance premiums, and software subscriptions.

Depending on the size of your operations, and whether you use an external fleet, fixed expenses can also include rent for vehicles and equipment, and fixed last mile carrier fees.

Fortunately, these costs don’t change and remain fixed.

So once you’ve calculated them the first time, you won’t have to calculate them again unless there’s a change in your operations. (Or until your suppliers change their rates.)

The next thing you need to take into account are your variable costs.

Variable operating costs are unpredictable expenses that change (or vary) over time (typically month by month). Variable expenses include hourly rates for employee overtime, utility bills, regular vehicle maintenance and repairs, tires, tolls, licensing for drivers, and more.

Fuel is yet another significant expense that makes up your variable cost.

Fuel costs can change dramatically over short periods of time, as they depend on both the price of fuel, and the amount of fuel that your vehicles consume.

So you’ll have to stay on top of them consistently to ensure your variable costs are accurate.

There are two types of mileage you need to track to calculate cost per mile:

Compensated mileage refers to the miles that drivers cover en route to complete a task. For example, when dropping off an order to a customer. These miles are compensated as they are included in the cost of delivery.

Deadhead mileage refers to the miles that drivers cover before or after completing a task. For example, when delivering goods from suppliers, driving to depots to load packages, or when returning with empty vehicles to the delivery hub.

Also known as empty miles, these miles are typically not transferred to the customer. And you treat them as a cost to your organization.

There is a difference between calculating the cost per mile for a single vehicle, and doing it for your entire fleet.

When calculating the cost per mile for just one vehicle, you’ll have to divide specific fixed and variable costs. While others remain vehicle specific.

For example, fixed expenses like rent or employee salaries are divided among all your drivers and their vehicles.

While variable expenses like fuel costs or overtime are specific to just that one driver. And when determining your total expenses, you add them up as such.

On the other hand:

When calculating cost per mile for a fleet, you can add up your expenses all at once. Since, each vehicle is a part of your fleet.

And you observe the cost per mile as an average value for your whole operation.

Finally, your cost per mile will depend on the period of time that you want to evaluate.

If you choose to calculate a daily or weekly cost per mile, the expenses or total mileage will vary a lot. And you won’t have a clear understanding of how much money you’re actually spending.

While, if you choose to calculate an annual cost per mile without observing it at a smaller level, you might miss out on key changes that have an impact on it.

That’s why most organizations, either calculate a monthly cost per mile, or bi-weekly.

Calculating the cost per mile month-by-month takes into account just enough expenses to give you an accurate estimate of your costs. While you can still add up each month to give you an overview of the yearly cost per mile.

Or you can calculate a bi-weekly cost per mile. As this gives them a more detailed overview of costs in situations when you expect costs to vary. For example, during peak seasonal demand.

Now, we’re going to show you how to track your cost per mile over time.

Of course, you can do this manually with pen and paper. Or an excel spreadsheet.

(No one is denying you do that.)

But we like to do things better. (And easier!)

So we’re also going to introduce some tools that will help you.

With that said…

From fixed and variable expenses to miles driven, here’s the exact process for tracking your cost per mile, step by step:

Start by selecting a time period that you want to observe. We suggest you track cost per mile every two weeks, or month by month.

Pro Tip: If it’s your first time tracking your cost per mile, you may want to start with a shorter time frame (a day or a week). You’ll have to collect fewer data and lower figures to work with.

Once you’ve selected the time period, it’s time to determine the total miles driven.

You should evaluate the total mileage per vehicle. But also the total mileage for the entire fleet.

To do this, you’ll need route optimization software.

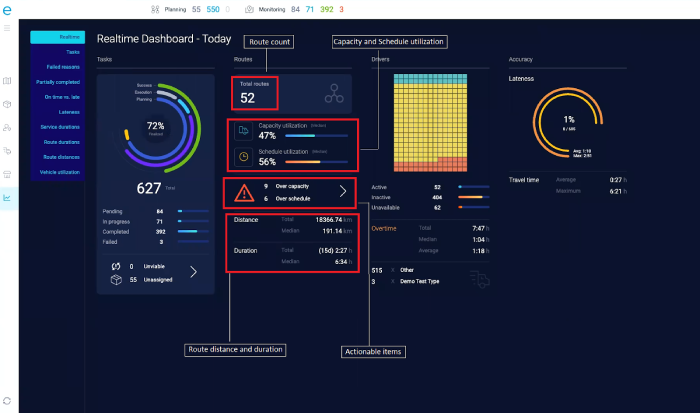

Routing tools like eLogii can track KPIs over time.

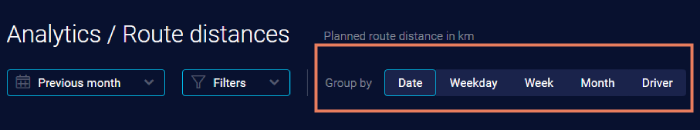

These solutions have an analytics feature that allows you to track and review real-time data:

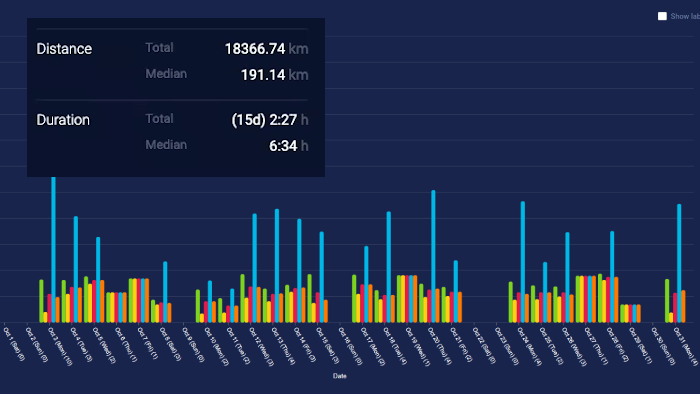

And historical data:

In both cases, you can see how many miles (or in this case kilometers) a driver has driven:

If you’re observing a longer period, for example a month, then you can switch to the historical data panel, and review the total miles driven per vehicle and for the whole fleet for any given period:

In short: With route optimization software you can determine your mileage with a few clicks of a button.

How to determine total mileage without software?

The alternative is to manually calculate the total mileage.

To do this, you’ll have to instruct each driver to mark the miles (or kilometers) on the counter in their vehicles at the start and end of each day.

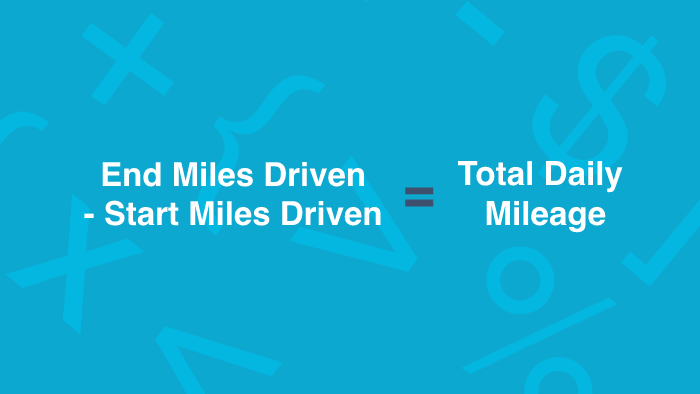

By subtracting these numbers, you get the total mileage per vehicle for each day:

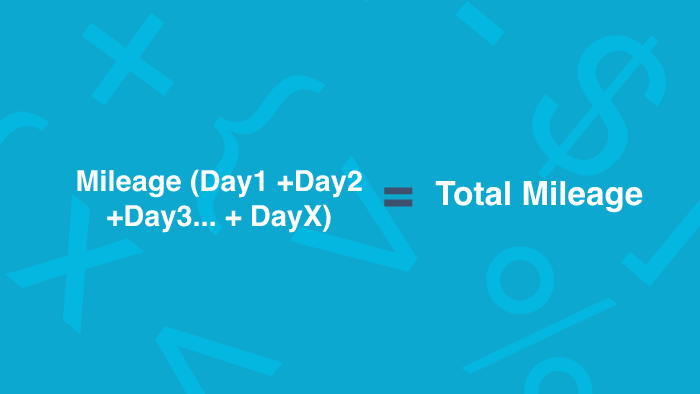

Adding up that number for each day over a the selected period gives you the total mileage for that timeframe:

On the other hand, adding up the daily total mileage of each vehicle gives you the total mileage of the fleet on that day.

And adding up those numbers over the selected period gives you the total mileage for that timeframe.

NOTE: Manually determining mileage doesn’t allow you to calculate compensated vs. deadhead mileage.

Next, track your fixed and variable expenses for the time period that you have selected for tracking your mileage.

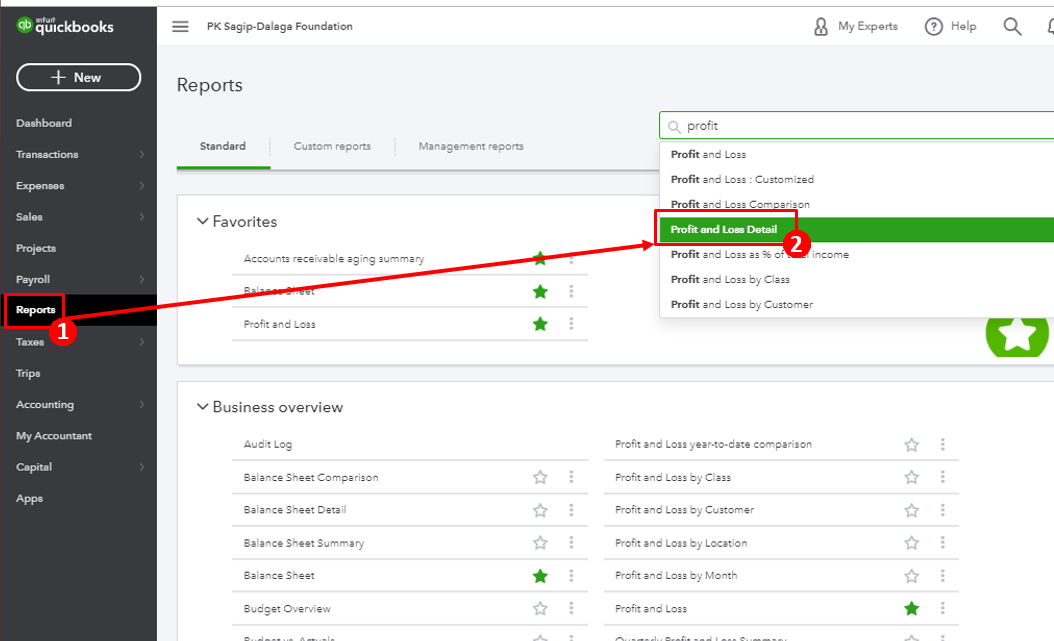

Using accounting software is the best way to track your total expenses. Typically, you’ll only have to select the time period to get a complete overview of your costs. (Including your total expenses.)

Here’s an example of how you can get a expenses report with QuickBooks:

Pro Tip: If you have a person dedicated to your business finances, like an accountant, just ask for a total expenses report for the selected time period.

How to determine your total expenses without software?

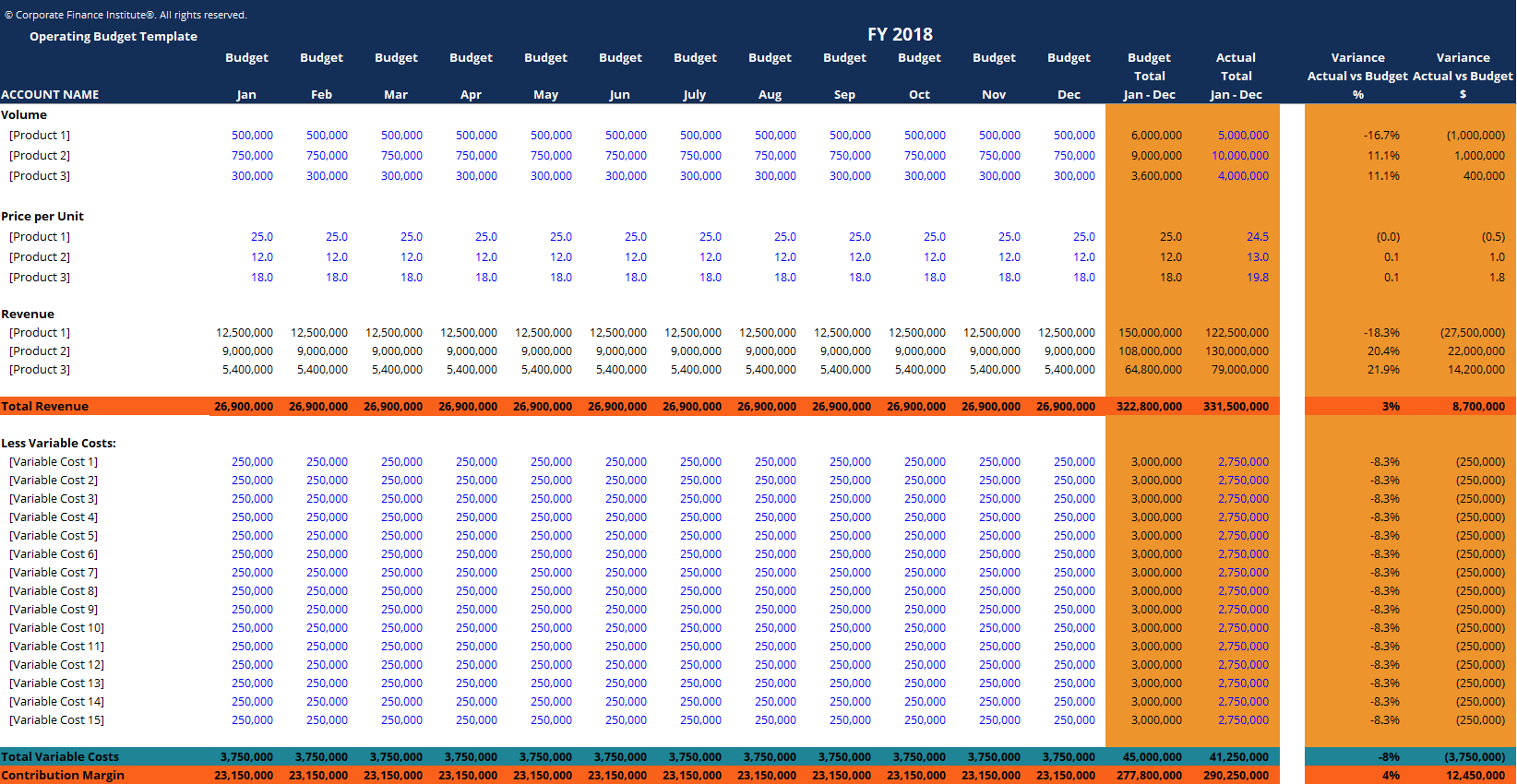

You can also determine your total expenses manually.

This is fairly easy to do with your fixed costs. And you can use a spreadsheet to add up your costs:

With variable costs, it’s a little more complicated. You have three options here:

1. You (or an accountant) can collect receipts and track variable expenses day to day.

2. You can limit variable expenses. For example, assign a fuel budget, or limit overtime.

3. You can task drivers to create daily reports that list out all variable expenses.

NOTE: In all three cases, the risk of human error is quite high. Which means your cost per mile may not be as accurate as it would be if you used software.

Once you have collected all of the data, all you have to do is divide your total expenses by the total miles driven to get your cost per mile:

Finally, this why you should track your cost per mile:

Cost per mile is a super important business metric that allows you to determine operating expenses.

Reviewing it over time helps you to determine the profitability of your current business model by evaluating the efficiency of your mobile workforce and operations.

The easiest (and currently best way) to do this is to use software. Specifically, cloud-based solutions.

Cloud-based software, such as SaaS, enables you to store vast amounts of data on the cloud.

Which gives you easier access to information.

And as you saw with eLogii, it’s faster and simpler to track, monitor, and review driving performance.

But it can also help you in other ways…

The truth is:

Your transportation costs account for 50.3% of all your operational spending.

And you can’t eliminate many of the expenses that negatively impact your cost per mile.

You can’t even reduce them to make a significant difference.

Fortunately, you don’t need to.

What you can do is use software to automate how you plan and manage operations.

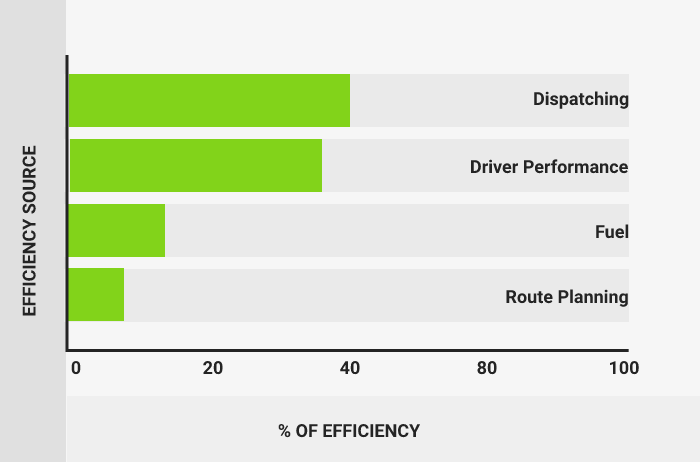

And in doing so raise efficiency in four key areas:

In doing so, you’ll achieve three things:

In fact, you can save 42% of operating costs with route planning software like eLogii.

That’s why we recommend you take the next step, and try out eLogii for free.

OnDivide the total revenue by the total miles driven, then multiply by 100. For example, if you earned $2,500 for a 2,000-mile trip, the calculation would be: (2,500 ÷ 2,000) x 100 = 125 cents per mile. It shows how much you earn per mile, but to determine profit per mile, subtract your costs per mile from your revenue per mile.

The main costs that affect a trucker's earnings are fuel, meals, broker fees, truck repairs, insurance, and lodging.

Rate per mile represents the gross income, showing the revenue coming into the business, while cost per mile reflects the total expenses of running the business.

Short-term durations are most effective for calculating cost per mile because they provide a clearer view of expenses, making it easier to identify inefficiencies.

Fuel consumption and the distance traveled are the primary factors affecting profitability in businesses with heavy driving. Extra miles or inefficient routes can lower profits, so it's crucial to prioritize finding the shortest route to maximize earnings.

Tracking and calculating cost per mile is a pivotal strategy that will help you manage transportation costs. By carefully considering fixed and variable expenses, along with monitoring mileage, you can gain valuable insights into your operational efficiency.

Using software like eLogii can make this process easier and more accurate, helping you save on fuel, reduce unnecessary mileage, and increase productivity. With a clearer understanding of your cost per mile, you can make smarter decisions that boost your business’s profitability while maintaining top-notch service.

We break down the transportation costs in last mile delivery to show you what affects it, how to calculate it, and how to lower transportation cost.

Learn to manage rising logistics costs in your business. Explore expenses, strategies to reduce costs, and optimize operations.

Considering starting a shuttle service? Discover cost-cutting strategies, optimization tips, and sustainability benefits for a profitable venture.

Be the first to know when new articles are released. eLogii has a market-leading blog and resources centre designed specifically to help business across countless distribution and field-services sub sectors worldwide to succeed with actionable content and tips.